In 2025, Snowflake Inc. is undergoing a significant transformation that reflects both the dynamic development of cloud data platforms and growing competitive pressure. The company’s shares are currently trading at around USD 198 (as of August 19, 2025), representing an increase of approximately 26% since the beginning of the year.

Strategic direction under the leadership of Sridhar Ramaswamy

New CEO Sridhar Ramaswamy took office with a clear vision of increasing efficiency, sales productivity, and broader integration of artificial intelligence into the product portfolio. The company has implemented a management system based on objectives and key results (OKRs), which enables more accurate performance evaluation. The result is Snowflake’s first billion-dollar quarter in history and double profitability at 9%.

Financial results and market position

Snowflake boasts a ranking among the elite 95 Plus Composite Rating Club, specifically with a rating of 96. This ranks the company among the top 4% of the best-performing stocks in terms of a combination of technical and fundamental indicators. While revenue is growing 26% year-over-year, profit growth in the first quarter reached a remarkable 71%. However, the EPS rating is still at a lower level (47/100), indicating room for further improvement.

Partnerships and alliances

A significant shift in partnerships is the appointment of Chris Niederman to the position of Senior Vice President for Alliances & Channels. With his experience at Amazon Web Services, he has the potential to strengthen Snowflake’s global partner network, which today includes more than 2,000 collaborating entities.

Competitive environment

Competitive pressure is intensifying, particularly from Databricks, which secured new financing in 2025 with a valuation of USD 100 billion. This represents an increase of more than 60% compared to December 2024. With annual revenues of $3.7 billion and 50% growth, Databricks is becoming one of Snowflake’s most significant rivals. In this context, investors and analysts are closely watching Snowflake’s upcoming second quarter results, which will be released on August 27, 2025.

Conclusion

Snowflake confirms its role as one of the key players in the field of cloud data platforms in 2025. Strategic changes in management, strengthening of the partner ecosystem, and a focus on AI create the conditions for further growth. Although competition, particularly from Databricks, is gaining momentum, Snowflake has a strong market position and positive growth momentum, which is also reflected in the growth of its share price.

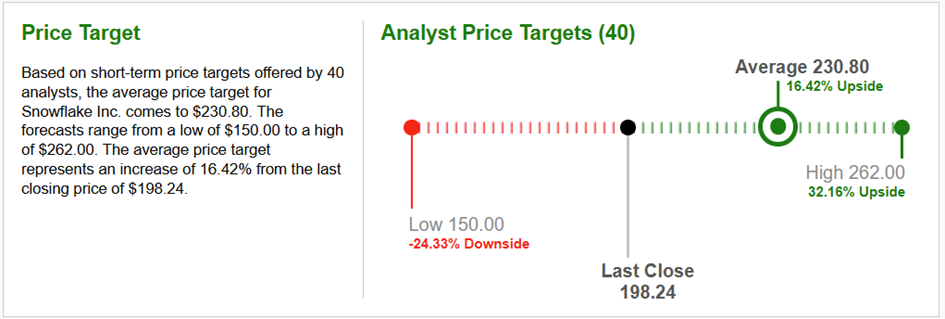

These facts attracted multinational investment corporations and private investors to purchase shares in Snowflake Inc. (NYSE: SNOW), for which the average target price for the short to medium-term investment horizon was set at USD 230.80 per share.