WeRide (WRD) continues to strengthen its position as a global leader in autonomous technology. In recent months, it has seen major technological innovations and strategic partnerships that are accelerating its expansion into new regions and segments.

Key news

• Robobus in Shenzhen – In collaboration with Shenzhen Bus Group, the first fully autonomous Level 4 Robobus (B888) was launched on August 26, 2025. The 6.6 km route in downtown Shenzhen is served by vehicles with advanced sensor equipment that provides 360° perception up to a distance of 200 meters and redundant architecture to ensure maximum safety.

• Collaboration with Bosch – AiDrive – Last week, WeRide, in collaboration with Bosch, unveiled its new AiDrive system, a unified end-to-end ADAS that integrates real-time perception and decision-making. This innovation will enable the technology to be deployed in mass production by the end of this year.

• Strategic investment from Grab – South Asian super app Grab has invested in WeRide with the aim of accelerating the introduction of robotaxis and autonomous shuttle services in Southeast Asia. The partnership includes technology integration as well as programs for education and local community development.

• Robotaxis in Abu Dhabi – Thanks to a partnership with Uber, the first fleet of fully autonomous taxis is now operating in Abu Dhabi. The service is available in tourist-friendly locations and represents a significant step towards the mass adoption of autonomous transport in the MENA region.

Conclusion

• Current price (August 2025): $9.60 per share, with a daily range of $9.45–$9.93 and a 52-week range of $6.03–$44.00.

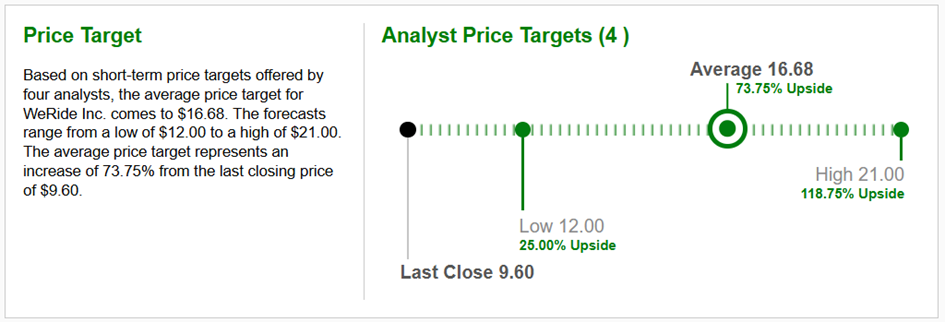

Expected development: Analysts predict growth potential up to an average target price of $18.67, which would represent an appreciation of almost 94%. These developments confirm that WeRide is on track to strengthen its technological and commercial dominance. The combination of advanced development, strategic alliances, and geographic expansion creates a solid foundation for long-term growth, even though the path to full commercial profitability remains challenging. WeRide is on the cusp of a new phase of growth. Investments by tech giants and strategic expansions indicate strong potential for stock appreciation. At the same time, however, the company faces high costs, regulatory challenges, and pressure to achieve rapid profitability. For investors, this represents an attractive but risky opportunity with a long-term horizon. Analysts at Zacks.com have set an average target price of $16.68 per share for the short to medium-term investment horizon.

Graph Source : www.zacks.com