General Electric (GE) has undergone extensive restructuring in recent years, resulting in the separation of three independently traded entities – GE Aerospace, GE Vernova, and GE HealthCare. This transformation has not only brought greater strategic flexibility, but also a significant increase in the value of some divisions’ shares. The year 2025 can thus be described as one of the most successful periods in the company’s modern history.

GE Aerospace: All-time high driven by demand in aviation

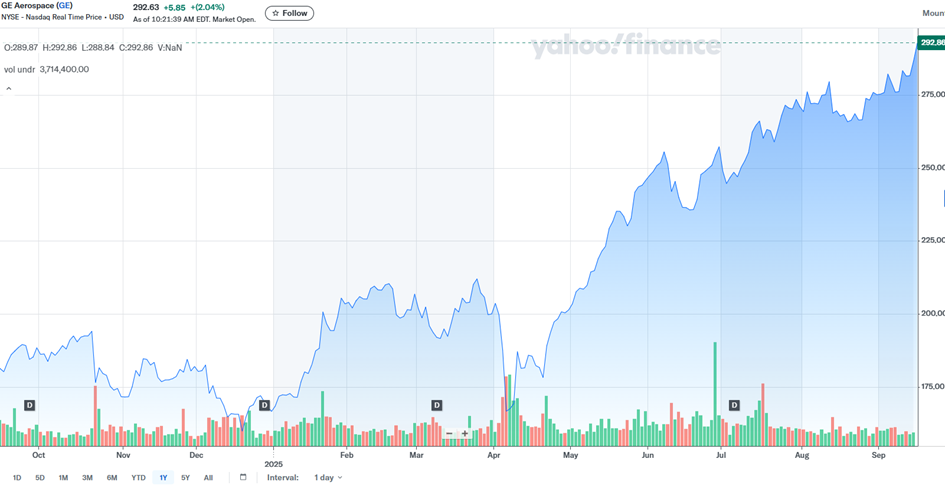

GE Aerospace shares reached an all-time high in September 2025, trading above $290 per share, surpassing the previous record set in 2000. The growth is mainly driven by strong demand for commercial aircraft engines and related services. In addition, the company has increased its full-year profitability estimate, further boosting investor confidence.

At the operational level, GE Aerospace is focusing on optimizing supply chains and managing cost pressures associated with tariffs and inflation. However, stable demand in the commercial aviation segment provides a strong foundation for growth.

GE Vernova: Fivefold growth after going public

Since its spin-off in April 2024, GE Vernova’s shares have appreciated approximately fivefold. The company is benefiting from growing demand for energy infrastructure, particularly in connection with the development of data centers and artificial intelligence, which require massive electricity consumption. Turbines for power plants and transmission network solutions are enjoying strong sales.

In September 2025, Vernova announced the sale of its Proficy software division to investment firm TPG for USD 600 million in order to focus more on key areas of grid software and infrastructure. At the same time, the company raised its revenue estimate for 2025 to the upper end of the original range (USD 36-37 billion) and improved its free cash flow estimate.

GE HealthCare: Portfolio development through acquisitions

The GE HealthCare division continues to position itself as a strong player in the field of medical technology. In 2025, it announced the acquisition of icometrix, a company specializing in AI analysis of brain MRI, thereby strengthening its portfolio in neurology. GE HealthCare shares are trading around USD 77–78, roughly a fifth below their 52-week high.

Although the stock’s performance lags behind that of other divisions, strategic acquisitions and innovations in diagnostic solutions indicate potential for long-term growth.

Social and labor aspects

In September 2025, GE Aerospace agreed with the UAW union on a new five-year collective bargaining agreement for its Kentucky and Ohio plants. The agreement includes increased benefits, job security, and shared healthcare costs, contributing to the company’s social stability.

Stock performance and outlook

• GE Aerospace: ~$290/share, +60-70% YTD, all-time high.

• GE Vernova: ~5× appreciation since IPO, revenues on an upward trend thanks to energy transformation.

• GE HealthCare: ~$77/share, below its all-time high but strengthening through strategic acquisitions.

The outlook for all three companies remains positive, driven by a combination of robust demand in the aerospace, energy, and healthcare industries. The main risks are macroeconomic pressures (inflation, tariffs), supply chain stability, and regulatory requirements.

Conclusion:

General Electric’s restructuring has enabled individual divisions to better respond to specific market opportunities. GE Aerospace is benefiting from the aviation boom, GE Vernova is positioning itself as a key supplier of energy infrastructure for the AI era, and GE HealthCare is expanding its technology portfolio. For investors, GE is once again becoming synonymous with innovation and growth, although the sustainability of high valuations will depend on the companies’ ability to deliver on their ambitious growth plans.

Graph Source : www.zacks.com

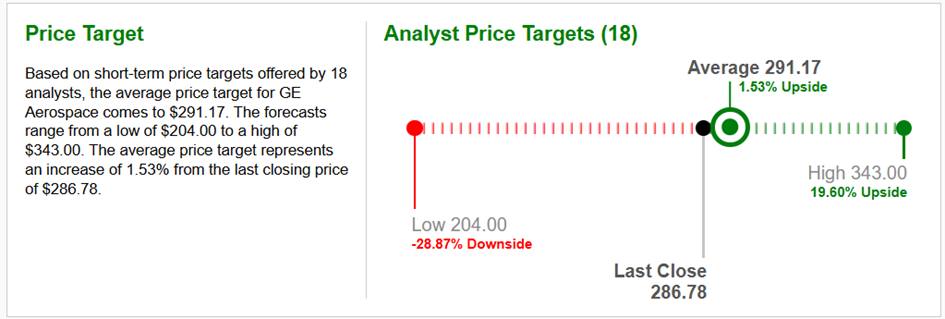

General Electric Company (NYSE-GE) also pays quarterly dividends to its shareholders. The dividend yield is currently 0.50% p.a. The dividend amount itself was approved by the company’s general meeting at USD 0.36 per share. The average target price for the short to medium-term investment horizon was set at USD 291.17 per share.