Nvidia Corporation is one of the most important players in the development of graphics processing units (GPUs) and accelerators for artificial intelligence. In recent years, it has experienced extraordinary growth thanks to the growing demand for computing power in data centers, particularly in connection with the development of generative artificial intelligence. This article summarizes the latest financial results, technological innovations, strategic risks, and the company’s stock performance as of September 2025.

Financial results

In the second quarter of fiscal year 2026, Nvidia achieved revenues of $46.7 billion, representing a year-on-year increase of 56% and sequential growth of 6%.

The Data Center segment remains the key driver, with revenues of $41.1 billion (+56% year-on-year). Products based on the Blackwell architecture saw quarter-over-quarter growth of 17%. For the third quarter, the company expects revenues of around $54 billion, slightly above the analyst consensus ($53.14 billion).

Product news

Nvidia introduced a new generation of Rubin accelerators along with the Vera processor and the Vera Rubin NVL 144 CPX platform, which is designed for computationally intensive AI applications with extended context.

The company also expanded its activities through Nvidia Venture, an investment division that supported quantum company Quantinuum (Honeywell) in a $600 million financing round.

Another significant step is the agreement with startup Lambda, which will lease back 18,000 GPUs worth $1.5 billion to Nvidia over a four-year period. This move signals a new strategy of expanding the availability of computing capacity through leasing.

Strategic aspects and risks

High revenue concentration remains a significant risk factor. The three largest customers generate more than half of the Data Center segment’s revenue. This makes the company vulnerable to changes in the strategy of key clients.

Geopolitical and regulatory issues

Relations with China are affected by export restrictions and regulatory interventions. Nvidia faces allegations of security risks associated with H20 chips, which the company denies. At the same time, an agreement with US authorities is in place whereby Nvidia and other manufacturers pay a portion of the revenue from chips sold to China as compensation to the United States.

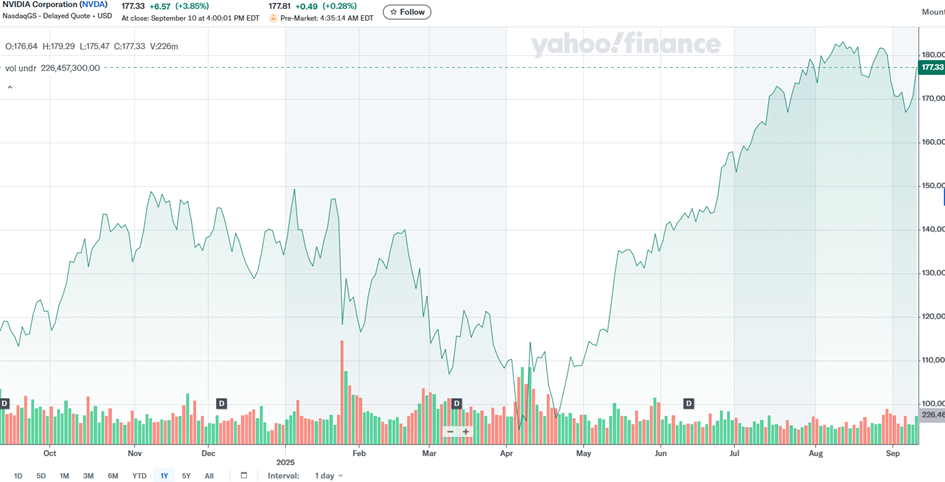

Share performance

Nvidia shares are currently trading at around USD 177. Although the latest results exceeded analysts’ expectations, the market reaction was rather subdued. Investors are focusing not only on the pace of growth, but also on the risks arising from geopolitics and high dependence on a limited number of customers.

Conclusion

Nvidia confirms its position as a global leader in AI accelerators and data centers. The financial results point to continued expansion, supported by the launch of a new product generation and strategic investments. At the same time, however, challenges related to the regulatory environment and high revenue concentration remain. The stock’s performance reflects not only strong fundamentals, but also investor concerns about the sustainability of the current growth rate.

Graph Source : www.zacks.com

NVIDIA Corporation (NASDAQ:NVDA) also pays regular quarterly dividends. The current dividend yield is 0.02% p.a. The dividend amount itself was approved by the company’s general meeting at USD 0.01 per share. The company currently has a known dividend payment date, known as the Pay-Date, which has been set for October 2, 2025. The last day to purchase shares using the dividend, known as the Ex-Div. Date, was set for today, September 11, 2025. The average target price for the short to medium-term investment horizon was set by 43 analysts from Zacks.com at USD 211.07 per share.