Current share price

As of September 30, 2025, Meta Platforms Inc (META) shares are trading at around $743.4, representing a negligible daily decline of 0.11%. Market capitalization is approximately $1.86 trillion, with a P/E ratio of 25.95.

Financial results and economic performance

In the second quarter of 2025, Meta reported:

• Revenue of $47.5 billion, representing year-over-year growth of 22%.

• Net income of $18.3 billion and adjusted earnings per share of $7.14 (+38% year-over-year).

• An operating margin of 43%, a significant improvement over the previous period.

The results confirm the stable growth of the core business and at the same time point to rising costs related to investments in artificial intelligence infrastructure and the expansion of data centers.

Technological innovations and product news

Meta continues to expand its technology portfolio:

• AI-video feed Vibes: A new platform integrated into Meta AI and the meta.ai website, enabling the generation and sharing of short videos created by artificial intelligence.

• Internal AI chip: Testing its own chip for training AI models to reduce dependence on external suppliers.

• Superintelligence division: Creation of a new unit focused on developing advanced artificial intelligence models.

• Ray-Ban Display smart glasses: Announcement of the first version of glasses with an integrated display and support through “Meta Lab” pop-up stores.

• Infrastructure investment: Plan to build a large data center in Louisiana with an emphasis on the use of renewable energy sources.

Regulatory and legal challenges

The company faces increased regulatory pressure:

• Antitrust lawsuit in the US: Allegations of monopolistic behavior in connection with Instagram Shopping.

• European Union and DSA: Threat of a fine of up to 6% of global revenue for allegedly insufficient moderation of illegal content.

• FTC vs. Meta: Ongoing litigation regarding the acquisitions of Instagram and WhatsApp.

• Content moderation policy: Termination of the third-party fact-checking program in the US and transition to the Community Notes system.

Share performance and market expectations

• The current price of around USD 743 reflects stable growth, supported by positive results and expansion in AI segments.

• Year-on-year dynamics are significantly influenced by market expectations regarding the return on massive investments in AI infrastructure.

• Regulatory risks remain a significant factor, which may affect the volatility of the stock in the short term.

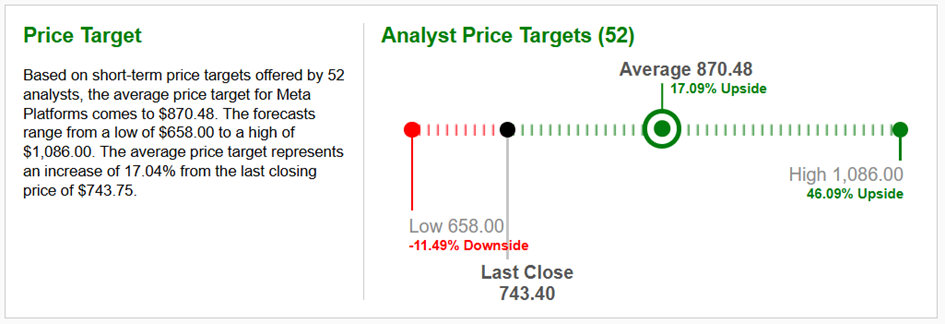

Graph Source : www.zacks.com

Conclusion

Meta Platforms confirms its position as a technology giant that is moving towards deeper integration of artificial intelligence into its products and services. Although the company faces regulatory challenges in both the US and the EU, its financial results and innovation strategy rank it among the most significant stocks on the US stock market. Investors are particularly focused on the company’s ability to monetize new technologies and effectively manage growing capital expenditures. Meta Inc. also pays regular quarterly dividends. The dividend yield is currently 0.28% p.a. The dividend amount itself was approved by the company’s general meeting at USD 0.53 per share. The average target price for Meta Platforms Inc. (META:NASDAQ) shares was set by Zacks.com analysts at $870.48 per share for the short to medium-term investment horizon.