Current share price

As of September 29, 2025, Nvidia Corp (NVDA) shares are trading at approximately $178.19, representing a slight daily increase. Over the course of 2025, the stock has achieved year-on-year growth of over 25%, although its performance remains sensitive to geopolitical and regulatory factors.

Strategic partnerships and investments

Nvidia has announced several key strategic moves in recent months:

• Partnership with OpenAI: Planned investment of up to $100 billion in the construction of artificial intelligence infrastructure and data centers. This includes the deployment of at least 10 GW of Nvidia systems.

• Collaboration with Intel: A $5 billion investment in Intel shares and an agreement to jointly develop data center and client products using NVLink technology.

• Agreement with CoreWeave: A $6.3 billion contract signed for the use of cloud capacity, further strengthening the ecosystem around Nvidia.

Technology development and product news

• Graphics chips for China: Resumption of sales of the H20 chip and development of a new version that complies with US export restrictions.

• China’s response: Authorities in Beijing accused Nvidia of possible security vulnerabilities (“backdoors”), which the company denied.

• DLSS 4: Introduction of new technology to increase performance in computer graphics, focused on efficient image generation.

• Future architecture: Announcement of the development of the Rubin / Vera Rubin generation, planned for 2026, with a focus on increasing performance in artificial intelligence applications.

Regulation and geopolitical influences

• US export restrictions: Impact on Nvidia’s sales, particularly in relation to the Chinese market.

• Revenue share: Nvidia and AMD have agreed to a 15% levy on revenues from AI chip sales to China as a condition for export licenses.

• Immigration policy: CEO Jensen Huang criticized the introduction of a $100,000 fee for new H 1B visas, saying it could limit the influx of talent.

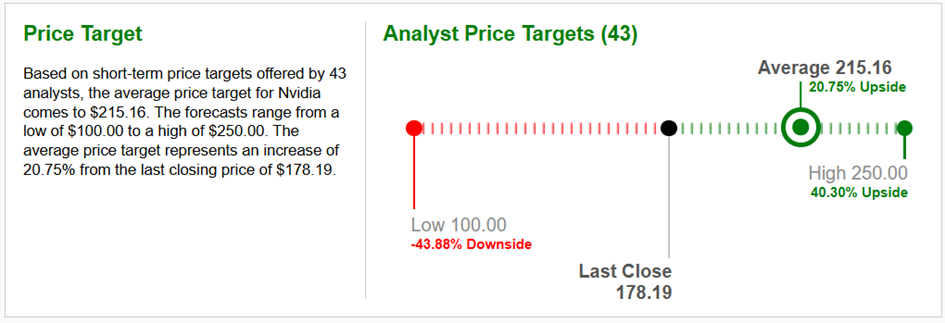

Graph Source : www.zacks.com

Conclusion

Nvidia remains a key player in the field of semiconductors and computing systems for AI. Its shares reflect a combination of strong technological position and geopolitical risks. Investors are primarily monitoring the further development of the partnership with OpenAI, the implementation of the new Rubin architecture, and the company’s ability to cope with regulatory restrictions in strategic markets.

NVIDIA Corporation (NASDAQ:NVDA) also pays regular quarterly dividends. The current dividend yield is 0.02% p.a. The dividend amount itself was approved by the company’s general meeting at USD 0.01 per share. The average target price for the short to medium-term investment horizon was set by 43 analysts from Zacks.com at USD 215.16 per share.